Mac Marketing Solutions, a marketing company for developers, released an article last Wednesday about the outlook of Richmond condo market in 2015. They reported that “There are currently 35 new residential projects selling in this marketplace (mostly concrete construction) and within these projects, 80% of the homes have already sold.”

MAC Marketing expected that the demand for new condo sales in Richmond will continue to be strong in 2015. However, as more master-planned communities are being built, the increased supply of available homes could slow down the rate of absorption of these new condos.

MAC Marketing expected that the demand for new condo sales in Richmond will continue to be strong in 2015. However, as more master-planned communities are being built, the increased supply of available homes could slow down the rate of absorption of these new condos.

According to their research, new concrete projects are selling around $535/sq ft to $580/sq ft depending on the location and the type of products (ie. Luxury, concrete or wood frame, etc). In addition, more end users (who buy to live in) prefer the Oval Village where it provides great value and amenities. The demographic of these end users are described as young, first-time home buyers or families that are looking to upgrade.

Where as investors (and a lot of Chinese investors) prefer to buy along No. 3 Road within walking distance to Lansdowne and Brighouse skytrain stations.

I personally find the new condos are so competitively priced that they are taking buyers away from the resale condo market. My buyers are mostly end users and after showing them both resale homes and pre-sale condos, the majority of them decided to spend a little bit of money and buy a brand new home instead of a condo even only a few years old.

Older condos do have their own benefits such as bigger floor area, bigger bedrooms and more affordable.

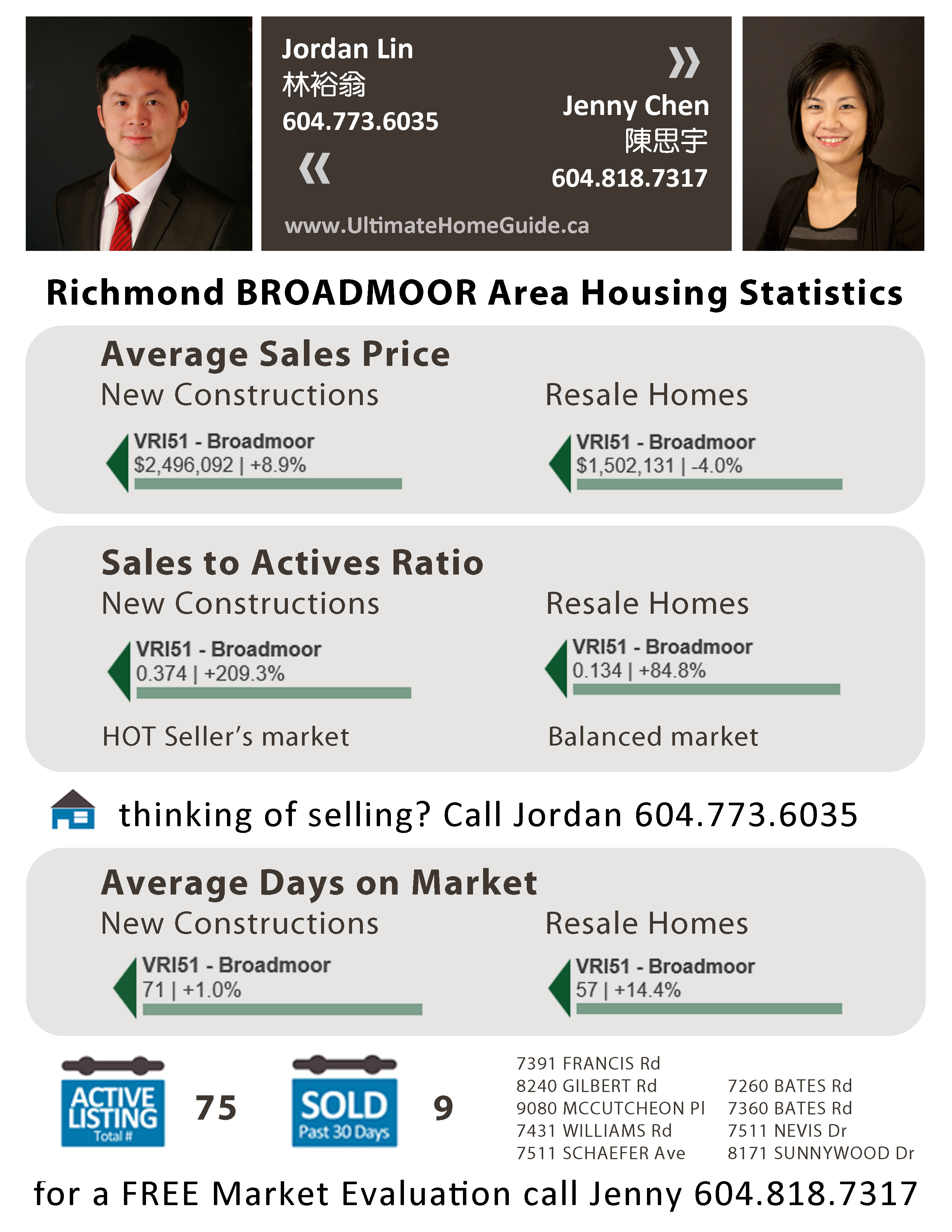

But as the statistics below shows, the activity in resale apartment condo is slower than the new construction in Richmond in 2015.

It is very interesting to hear the experts talk about their real estate markets and see their perspectives on the Greater Vancouver housing market.

It is very interesting to hear the experts talk about their real estate markets and see their perspectives on the Greater Vancouver housing market.