The Real Estate Board of Greater Vancouver reported the sales-to-active-listings ratio currently sits at 21.3% in Greater Vancouver, which is the highest it has been since June 2011.

What does that mean and how does it relate to questions like Where should I buy my next home? How much is my home worth?

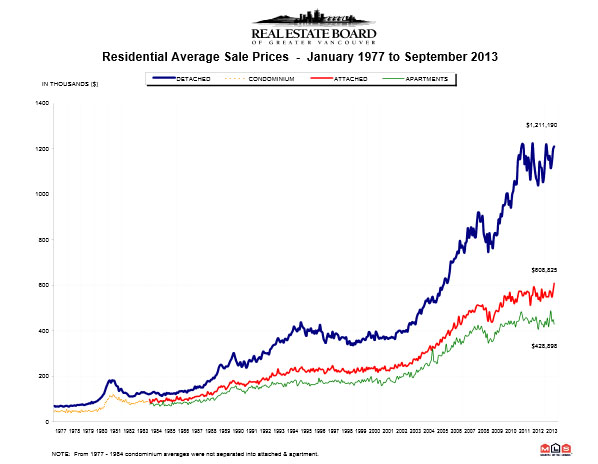

The sales-to-active-listings ratio is used to as an indicator of supply and demand because it is simple to calculate and understand. The housing price is determined by supply and demand. When the supply of homes for sale (listings) and the demand from potential homebuyers is in equilibrium, we have a balanced housing market.

Seller’s market is when price appreciation above inflation is likely.

Buyer’s market is when price appreciation will be less than expected inflation.

Some say it is a balanced market when the sales-to-active-listings ratio is between 15-25%, some say it’s between 15-20%. A Vancouver local real estate veteran told me he has his own numbers of 12-22% as an observation after 30 plus years in the industry.

The real estate markets have some common drivers such as interest rates which are determined by inflation and economic growth. However, the real estate is very local. Drivers like demographics, income trends, population densities, net migration and share of first-time homebuyers have significant variation within a province or even neighborhoods within a city and it can lead to very different dynamics.

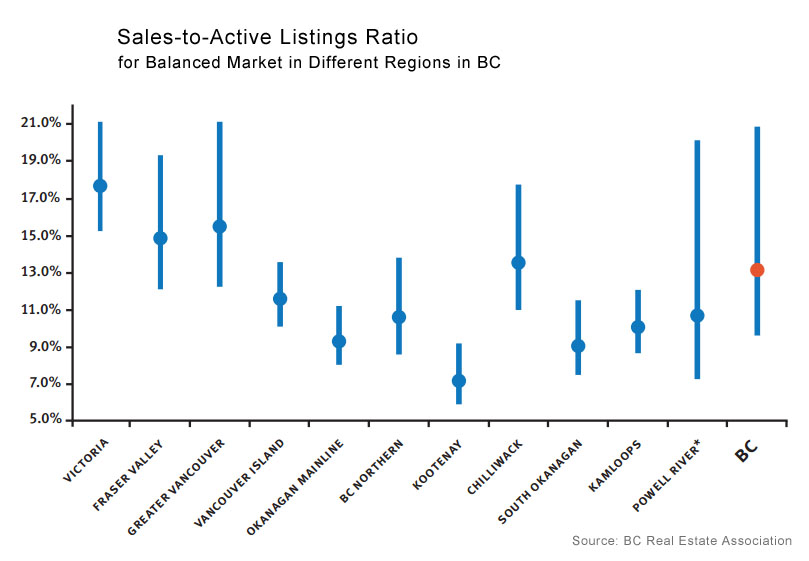

As a result, the BC Real Estate Association has performed a regression analysis to uncover the ratios for a balanced market in different real estate board regions in BC. In the analysis, it assumed balanced markets are markets in which home prices grow in line with inflation.

In Greater Vancouver, a balanced market has a sales/actives ratio of around 12-21%; In Fraser Valley, about 12-19% and in Victoria about 15-21%.

The REBGV reported the sales/actives ratio is 21.3% in Greater Vancouver in June, the highest since June 2011. This means that every 100 available homes on the market, 21.3 are sold every month and Greater Vancouver is seeing a balanced market tipping towards a seller’s market.

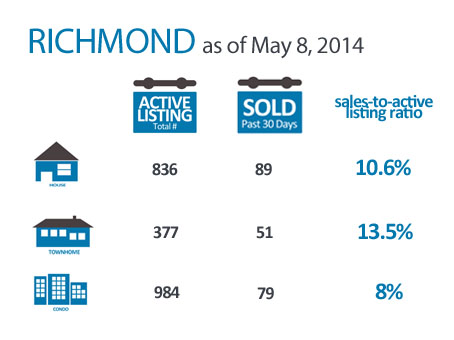

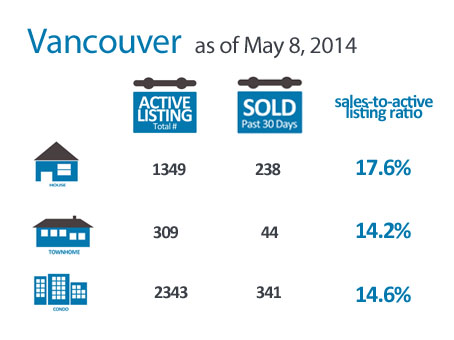

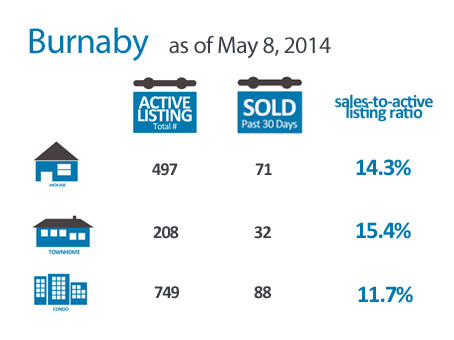

And let’s look at the Sales/Active Ratio for your city, your property type. Is it above or below the Greater Vancouver average? Is it a Seller’s, Balanced or Buyer’s Market? Is the price going up or staying flat?

- Vancouver all property types are showing a seller’s market meaning good time to sell for homeowners with healthy demand from potential homebuyers.

- Burnaby townhomes are in hot demand but Coquitlam townhouses are super hot. A lot of demand from potential homebuyers and upward pressure on prices.

- Richmond condos in balanced market but very close to buyer’s market. It is a good time to buy if you have been looking into buying a Richmond condo.

We can go even deeper into specific areas like the Olympic Village or Brentwood in North Burnaby to see what kind of market condition it is right now. Feel free to contact us about your specific area whether you are buying or selling.