This summer, real estate activity increased as compared to the first half of 2019.

“Home sales returned to more historically normal levels in July and August compared to what we saw in the first six months of the year,” said REBGV President Ashley Smith.

Buyer activity had increased, although sale is still below the 10-year aveage.

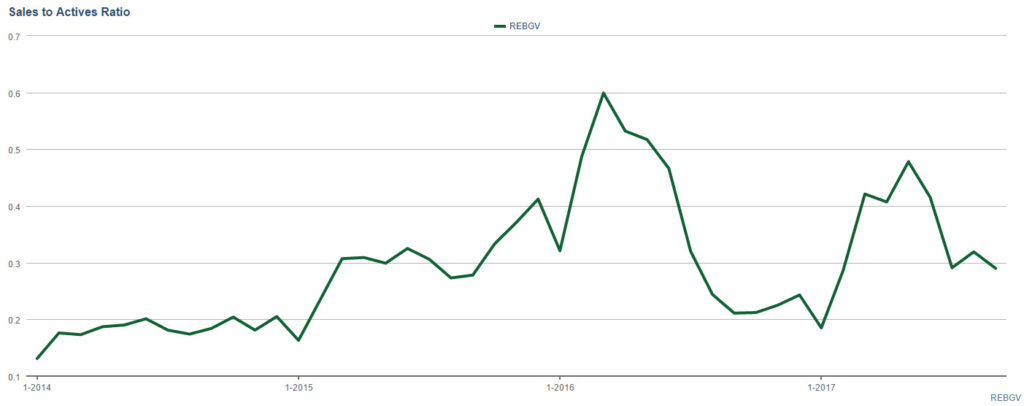

The sales-to-active listings ratio for August 2019 is 16.7%, a slight decrease from the 18% in July 2019 in Metro Vancouver. The ratio is in the balanced market range. For a breakdown of ratios for different property types, please see the table below:

The ratio also varies in different areas in Metro Vancouver. For example, we are seeing the condos in Brentwood are sold fairly quickly if priced well.

For condos, the sales-to-active listings ratio for both July and August 2019 had surpassed the 20% market.

According to analysts, if the ratio surpasses 20% for several months, we often see an upward pressure in price.

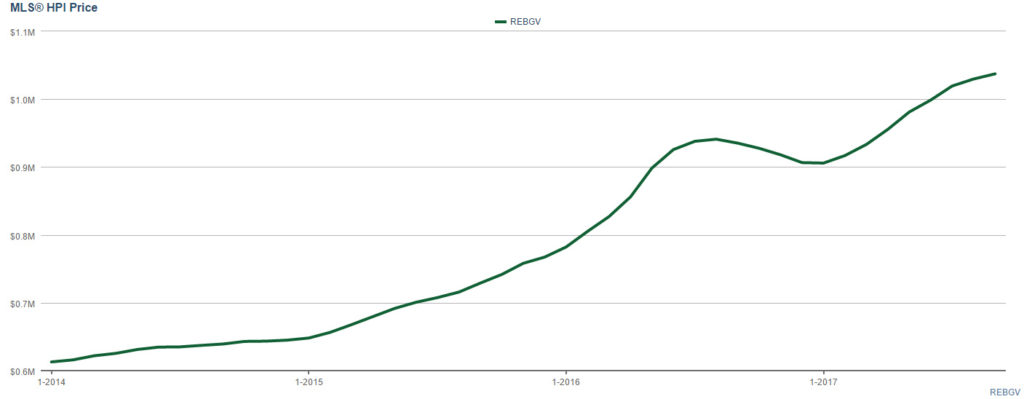

Sales of condo increased 8.9% in August 2019 compared to the same month last year. The benchmark price of condo decreased 7.4% from same month year to $771,000. Although sales went up, inventory was also up, making sales-to-active listings ratio lower as compared to the heated seller’s market a few years ago (hence the lowering in price).

Condominium remained in higher buyer demand as compared to other property types due to its lower price point.

Buyers still benefit from the low interest rates, increased inventory and reduced prices in this balanced market.

On September 4, 2019, Bank of Canada left the benchmark interest rate unchanged at 1.75% as trade war between China and the US was doing more damage on Global economy than forecasted in July 2019.

The Top 6 Things That Will Impact Fall Real Estate in Canada

The Decrease in The Bank of Canada’s Mortgage Stress Test is Great News