CMHC has released its latest Housing Market Outlook which is released annually at the beginning of the fourth quarter and looks ahead over the next two years.

In general CMHC sees a stable, but slowing housing market.

Housing starts are expected to decline over the next two years as the economy strengthens and the Bank of Canada withdraws stimulus – that is, interest rates continue to rise.

CMHC is forecasting posted, 5-year mortgage rates of 4.9% to 5.7% next year and 5.2% to 6.2% in 2019. That is an increase of as much as 160 bps over the time horizon of the outlook.

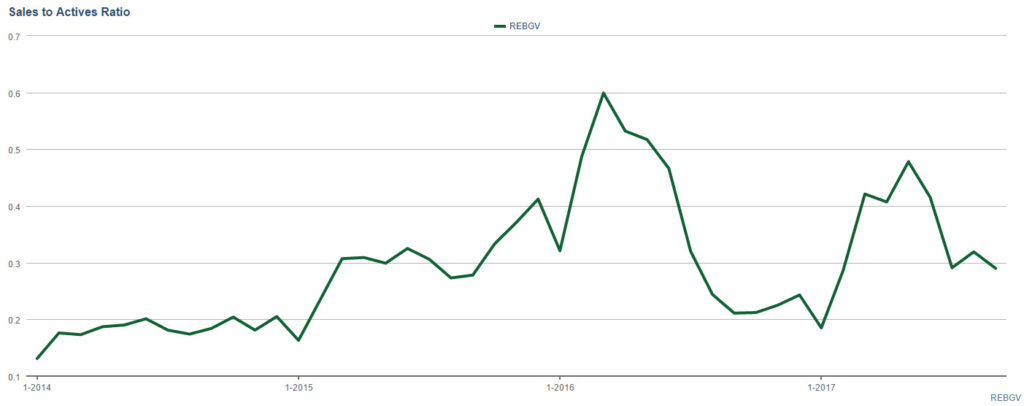

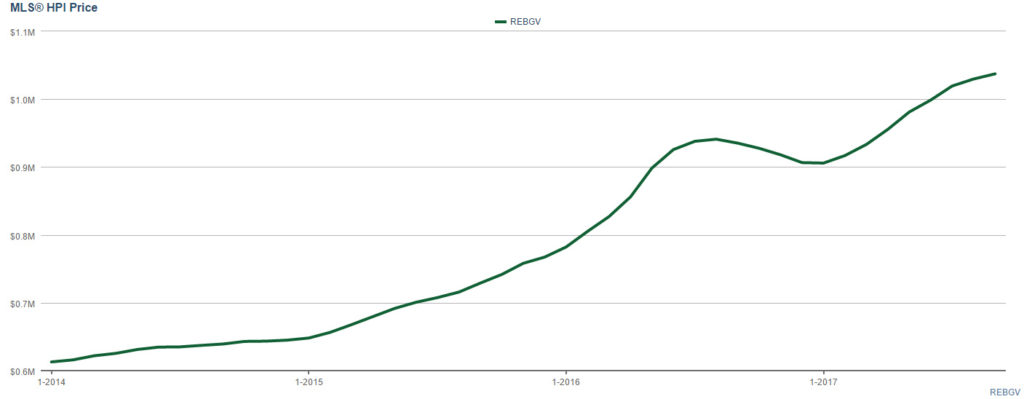

Existing home sales are forecast to drop. This should be no surprise given the record setting pace of sales through 2016 and early 2017. As well, the pace of price increases is expected to slow down.

CMHC predicts the national average price for a home should fall somewhere between $494,000 and $511,000 this year. In 2019 the range is expected to be between $499,000 and $524,500.

CMHC is also forecasting ongoing growth for GDP, employment and immigration. But the agency expects consumer spending to decline as interest rates increase.